Electronic Invoicing (IT)

Italian Electronic Invocing (also known as FatturaPA) is defined by government rules through the "Agenzia delle Entrate".

Fatturazione elettronica PA - FatturaPA

Most sales invoices must be sent to customers and most purchase invoices are received from vendors. Only few exceptions are allowed.

Electronic Invoices can be exchanged manually (via certified e-mail PEC or via authorized provider) or automatically (Business Central can contact the provider via Web Services).

Company Information Setup

In the "Company Information" page the following data are mandatory:

- "Company Type" (for example "01" for normal tax system)

- "VAT Registration No." (in ITxxxxx format)

- "Fiscal Code"

- Complete name and address with country code and county

- "Liquidation Status"

- "REA No." and "Registry Office Province"

Payment Methods

Each payment method must be related with the government one.

Fill the "Fattura PA Payment Method" in the "Payment Methods" page.

Customers

For each customer the following data are mandatory:

- "VAT Registration No." (in ITxxxxx format)

- "Fiscal Code"

- Complete name and address with country code and county

- "PA Code" or "Send E-Invoice via PEC"

"PA Code" is the code of the provider of the customer, similarly to the domain name after @ in the e-mail addresses. For private company "PA Code" is 7 character length, for governative agencies is 6 character length. Use "XXXXXXX" for foreign customers, use "0000000" to use the default provider that customer has defined in the public registry.

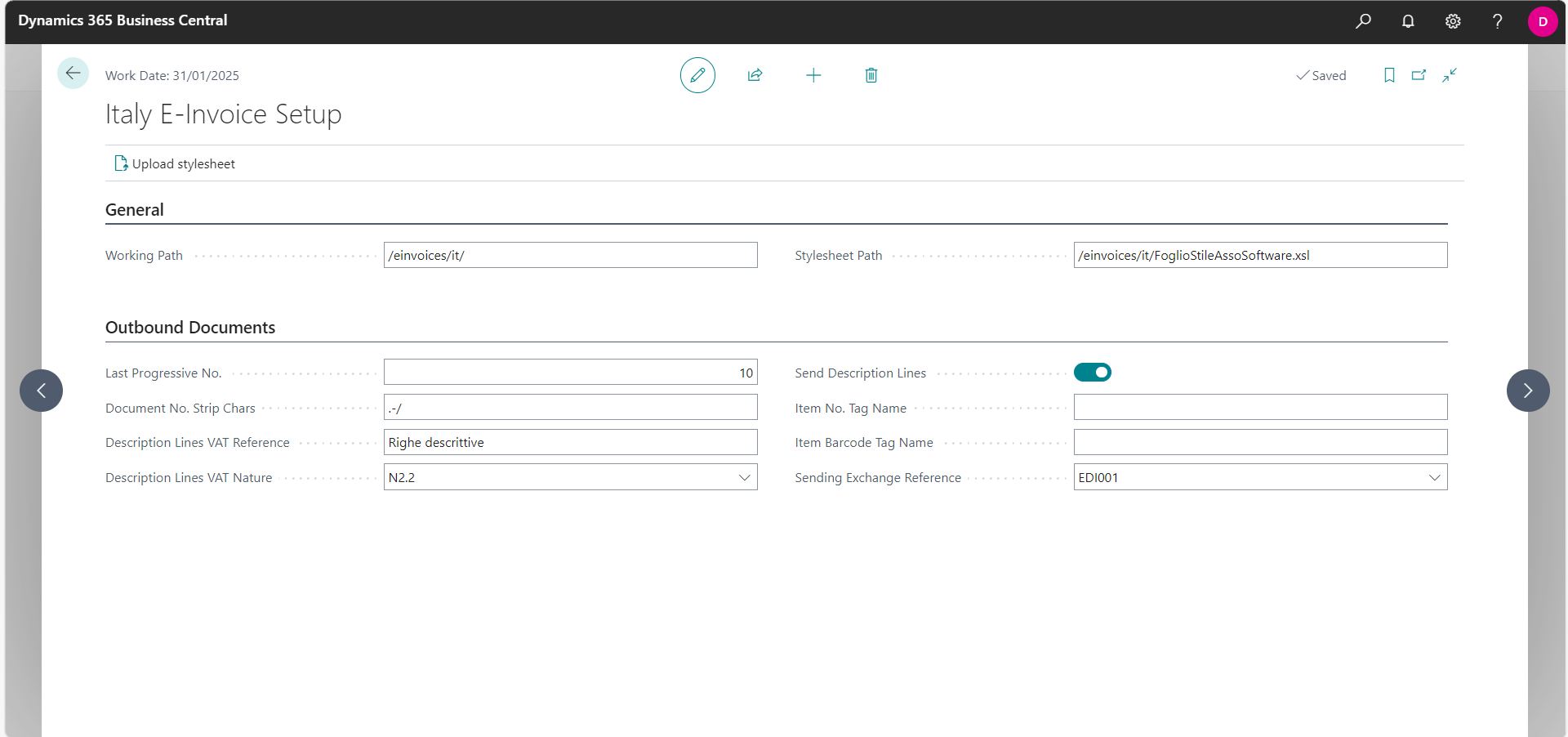

E-Invoice Setup

The "Italy E-Invoice Setup" contains all specific parameters of the function. "Working Path" is the virtual file system path to store sent and received e-invoices and their attachments.

It's possible to strip unwanted characters from document numbers and to define a custom Exchange Reference to map internal code with external ones (for example change Unit of Measure Code).

It's possible to upload an XML/XSL to pretty format the e-invoices for printing. This is one of the mostly used stylesheet in Italy: https://for.assosoftware.it/assoinvoice

Exchange Profile

You can define several e-invoice exchange profile, one for each provider that you use. If you don't have a provider but exchange the invoices manually, select "Download/Upload" transport.

In the "Document Exchange Profiles" page select "Italy E-Invoice" as format and enable it.

Prepare an invoice for sending

In the "Posted Sales Invoices" page (or "Posted Sales Credit Memo") select the action "Document Exchange" and select the export option. For each selected document an E-Invoice is created.

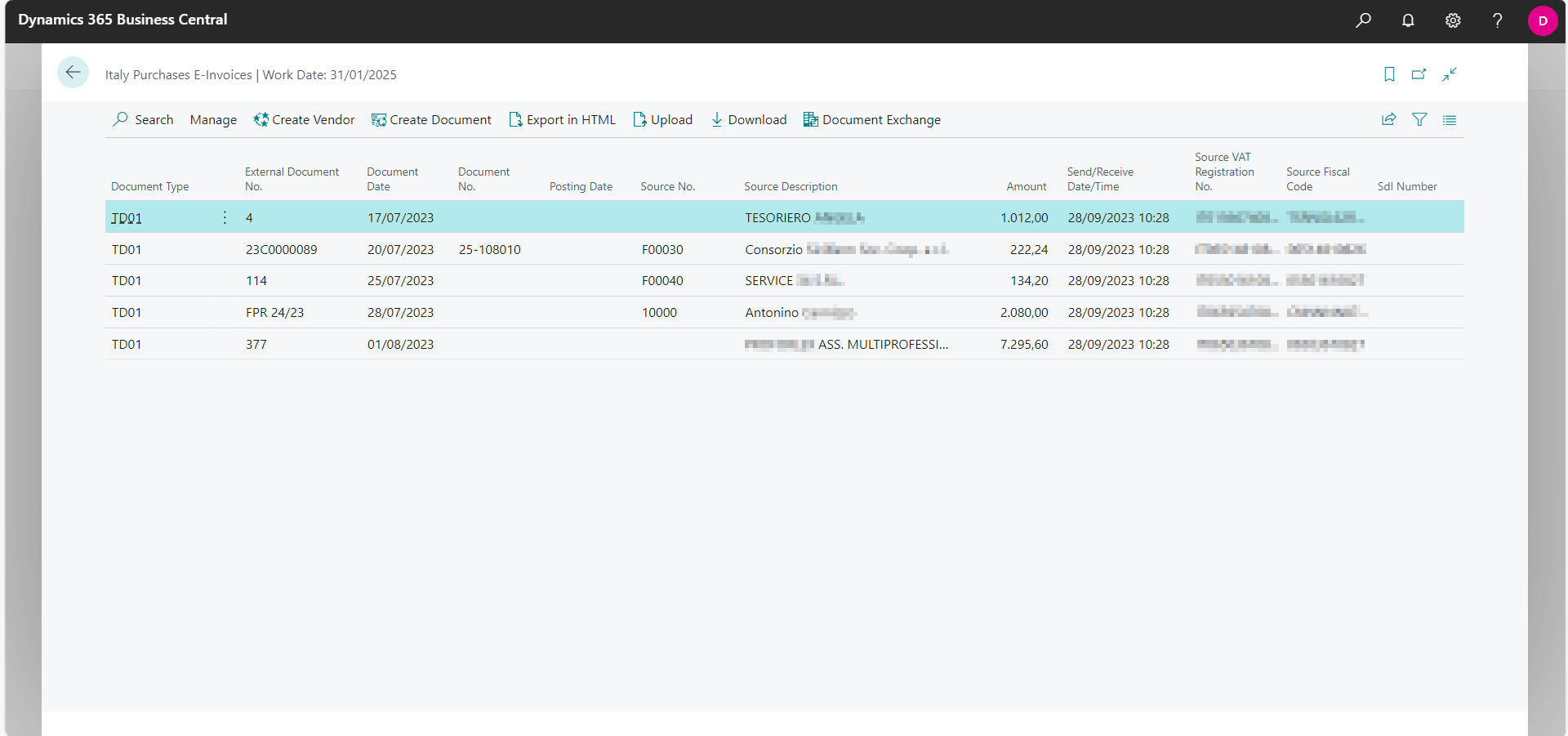

Sales and Purchases E-Invoices

The pages "Italy Sales E-Invoices" and "Italy Purchases E-Invoices" allows you to view and filter all e-invoices created or received. It's possible to:

- Delete and recreate the wrong E-Invoices

- Export the E-Invoices as original XML o formatted HTML

- Massive send or receive the E-Invoices

- Automatically create new vendors

- Automatically create purchase invoices or credit memo by predefined rules

These pages are very important to assert that all sales and purchases invoices have been posted.