VAT Shareout "Ventilazione"

These business can declare to government that:

- Purchases are well divided per VAT rate

- Sales are made in aggregated form, without applying any VAT rate

To pay the right taxes, these business need to calculate "Ventilazione" that is VAT rate to apply to sales proportionally to purchases.

The calculation is made starting from the 1° january of each years to the end of each VAT period.

Example

| Month | VAT rate | Purchase amount | Shareout % |

| January | 4 % | 10.000 | 16,53 % |

| January | 10 % | 33.000 | 54,55 % |

| January | 22 % | 17.500 | 28,92 % |

| Total | 60.500 | 100 % |

The aggreate sales of January are 97.000 so the VAT to pay is:

| VAT rate | Shareout % | Sales amount (incl. VAT) | VAT amount |

| 4 % | 16,53 % | 16.034 | 641 |

| 10 % | 54,55 % | 52.914 | 5.291 |

| 22 % | 28,92 % | 28.052 | 6.171 |

| Total | 100 % | 97.000 | 12.103 |

New purchases of February increase previous totals and generate a new shareout for February sales:

| Month | VAT rate | Purchase amount | Shareout % |

| January + February | 4 % | 22.000 | 18,72 % |

| January+ February | 10 % | 59.500 | 50,64 % |

| January + February | 22 % | 36.000 | 30,64 % |

| Total | 117.500 | 100 % |

And so on...

Setup

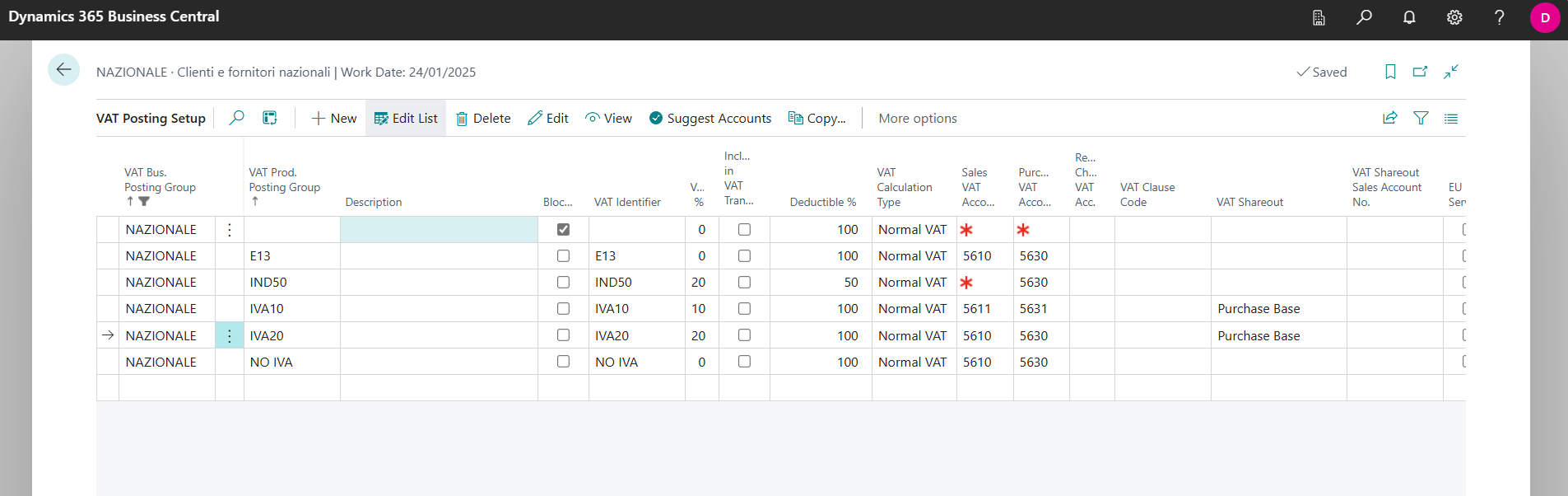

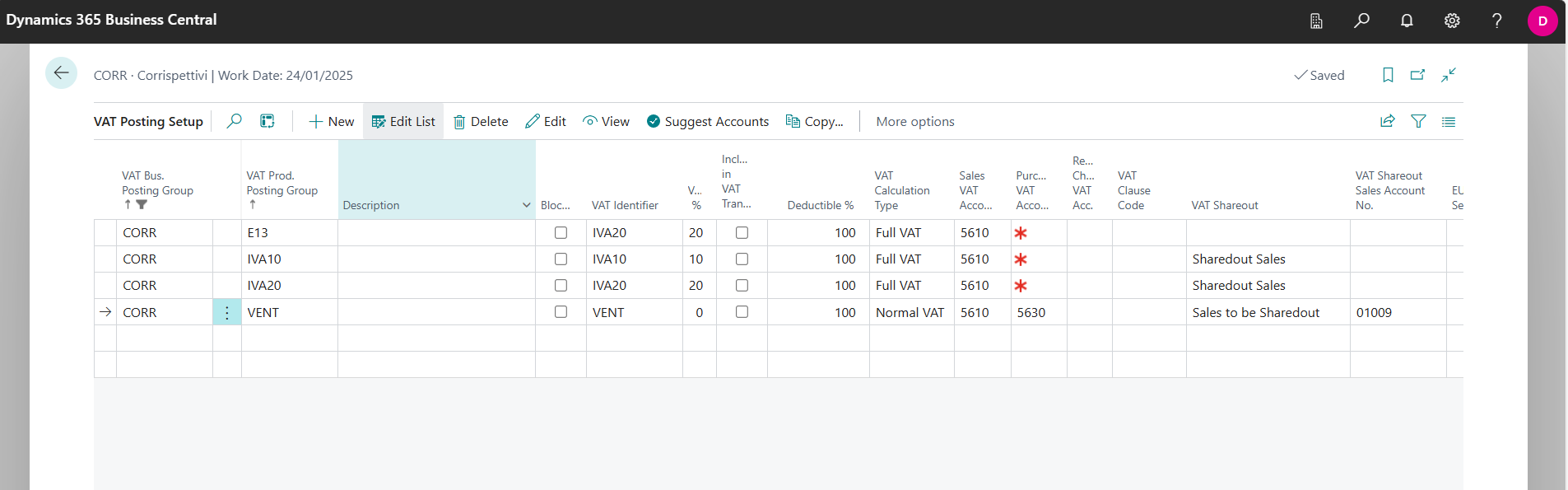

In "VAT Posting Setup" table mark interested purchase lines for "base" in the shareout calculation.

Also mark the sales lines:

- That ones aggregated "to be sharedout"

- That one after calculation "sharedout"

For lines to be sharedout is necessary also to specify the G/L account for reversing the calculated VAT (sales are posted "included VAT" and need to be reducted for the amount of VAT).

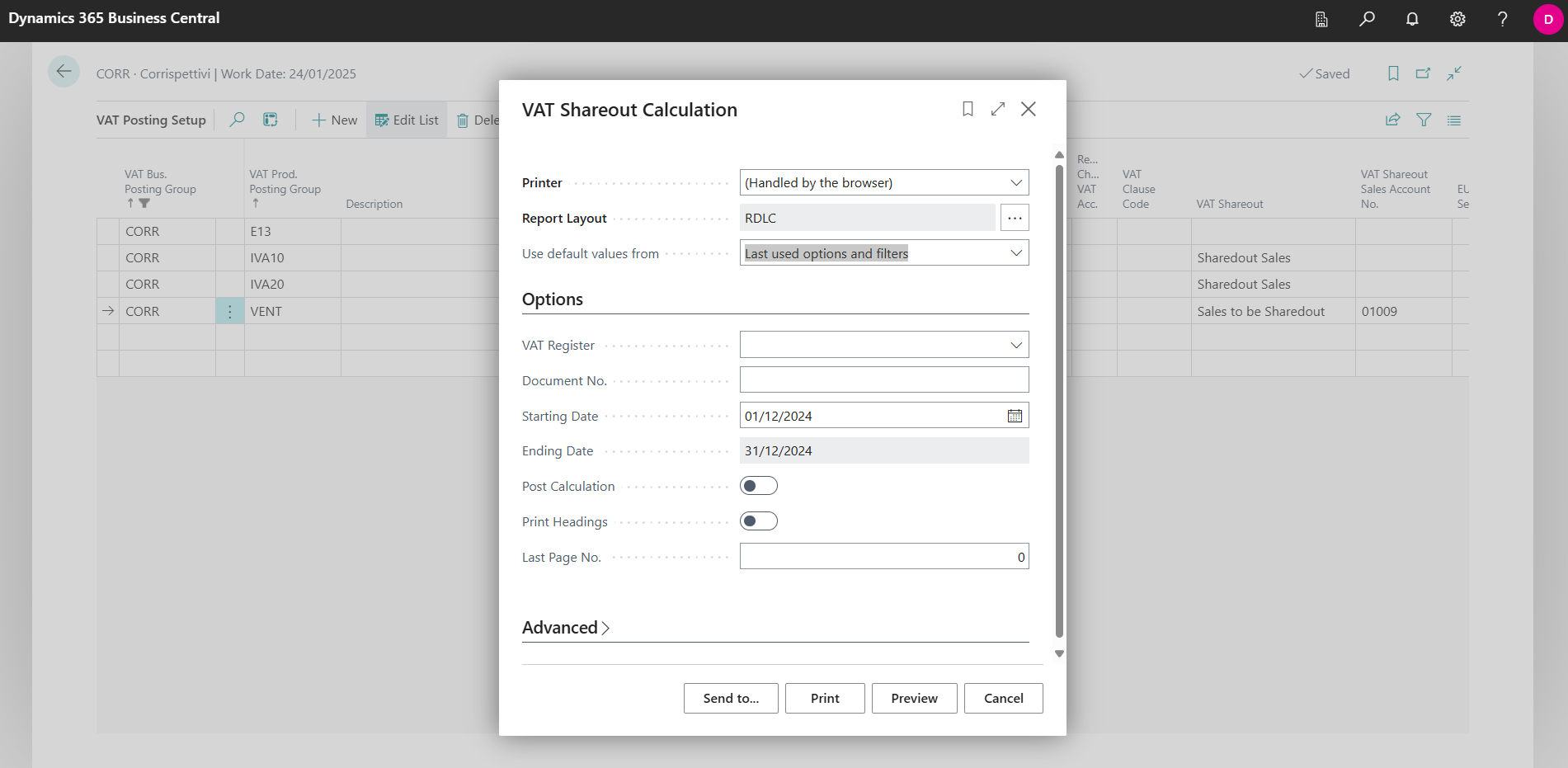

Before VAT settlement, run and post VAT shareout calculation.